The JSE: facilitating share trading since 1887

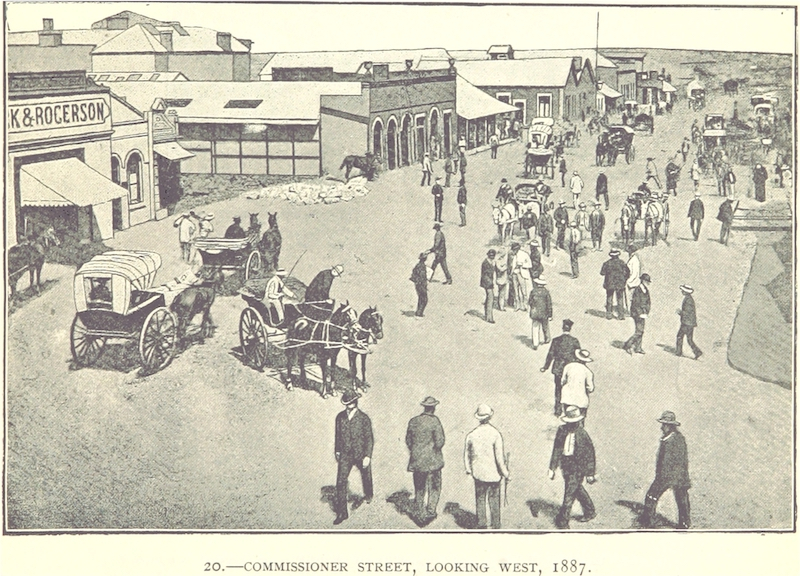

8 November 1887: On the dusty streets of the brand new city of Johannesburg, what was to become Africa’s oldest stock exchange was established. It was set up in a canvas tent on Commissioner Street – a major thoroughfare that runs through the city from east to west.

Today Commissioner Street is abustle with cars, buses, bicycles, motorcycles, street vendors, performers and pedestrians all going about their business. Back in 1887, however, it was the centre of the Witwatersrand gold rush. Men and women from around the world were streaming to the area to find their fortune, and Commissioner Street was an important conduit for the trade of gold.

Photo: Wikimedia Commons

Within a few weeks of its official opening, the Johannesburg Exchange and Chambers Company had close to 70 listings. Just over two years later – in January 1890 – there were more than 300 companies listed.

The exchange soon outgrew its premises and changed its name – a process it was to repeat several times over the years. Today, many premises and name-changes later, the JSE Securities Exchange is located in Joburg’s new financial hub of Sandton, on the corner of Maude Street and Gwen Lane. It is the largest and oldest existing stock exchange in Africa, and the 19th largest exchange in the world by market capitalisation. In June 2018 there were 375 companies listed on the exchange, down from the all-time high of 485 in September 2002.

But that’s all just history, geography and statistics. The most important thing about the JSE of today is that it’s a solid pillar of the South African economy. It offers all people – old or young, rich or poor – the opportunity to grow their personal wealth while contributing massively to the economic success of our country.

“The JSE, and in fact any stock exchange, is often seen as an inaccessible bastion of capitalism that’s only available to people who have already accumulated their wealth,” says Charles Savage, CEO of CN&CO partner EasyEquities. “This perception couldn’t be further from the truth.

Charles Savage

“With the democratisation of the stock exchange in 2015 – yes, it’s a real thing – anyone can own shares.”

But what are shares exactly? It’s a nice word… “shares”. It’s implies participation by many people. Everyone shares in the shares. And that’s the crux of it. Simply put, shares are bits of companies. So if you own shares in a company, you effectively own a bit of that company – and that makes you a shareholder.

Shares are issued by companies looking to raise money (capital). Once the shares are issued, they are traded on the open market via the stock exchange. It works on a willing buyer, willing seller principle. So if you want to buy shares, say, in Woolworths, you need to find someone who is willing to sell shares in Woolworths at a price that is acceptable to you both. The stock exchange facilitates this process.

“Just like you go to a car dealer or a website such as gumtree or olx to buy or sell a car, so you go to a stockbroker or an investment platform such as EasyEquities if you want to buy or sell shares,” explains Charles. “The desirability of the car or the shares in question will determine the price.

“Continuing with the car analogy… if you go to a car dealer, you’ll probably end up paying a lot more for the vehicle than if you go and look online. It’s the same with shares. Buying via a stockbroker will be more expensive than buying through an online trading platform.

“And just like buying a car, everyone has a different way of going about buying shares. Some are happy to buy a brand they know, some want to do extensive research, some make their decision based on current and prospective future value.”

The difference between cars and shares is that shares tend to grow in value, while cars tend to lose value as they get older. The JSE is also subject to strict financial controls

“Listed companies must obey the rules and the JSE itself has a strict set of ethics and conduct rules it has to stick to,” explains Charles.

In short, buying shares is probably way more profitable in the long run than buying cars. (Granted, you can’t drive your shares to work, but at least you don’t need a licence to own them!)

Shares are for everyone

There are more than 12 million cars in South Africa, yet the number of South Africans with direct share ownership is less than 400 000.

“The frightening thing is, you can become a shareholder for less than R50,” says Charles. “You could never buy a car for that price!”

We’ve come a long way since the JSE was started in 1887 – some 10 years before the first car arrived in South Africa, incidentally. Today there is no dust or queuing involved in buying shares. Simply log on to www.easyequities.co.za and voila! You can become a shareholder in a few clicks.

Try THAT at the licence department.

But before you go, remember … shares make excellent Christmas gifts. So if you haven’t finished your shopping yet, visit the EasyEquities website or click on the gift icon to the right and buy your loved one/s a gift. Sharing is caring.