RISE to meet your retirement head on

For many people, retirement is a big, scary beast that looms large at the end of their working lives. Will I have enough money to retire on? That’s the big question.

Working on the answers is plethora of super-smart, super-qualified financial advisors, asset managers and retirement fund administrators, including Deresh Lawangee. Deresh is CEO of RISE (Retirement Investments and Savings for Everyone), a joint-venture partnership between EasyEquities and NBC Fund Administration Services.

Deresh recently facilitated the RISE Premium Knowledge Workshop, which focused on defined contribution investment strategies, as well as strategic approaches for after retirement.

Some of the interesting points raised in the workshop were:

- Life stage investing vs one-size-fits-all vs individual investor choice

- The income replacement ratio – what it is and how to get it up

- Life annuity vs living annuity post retirement

Investment approaches

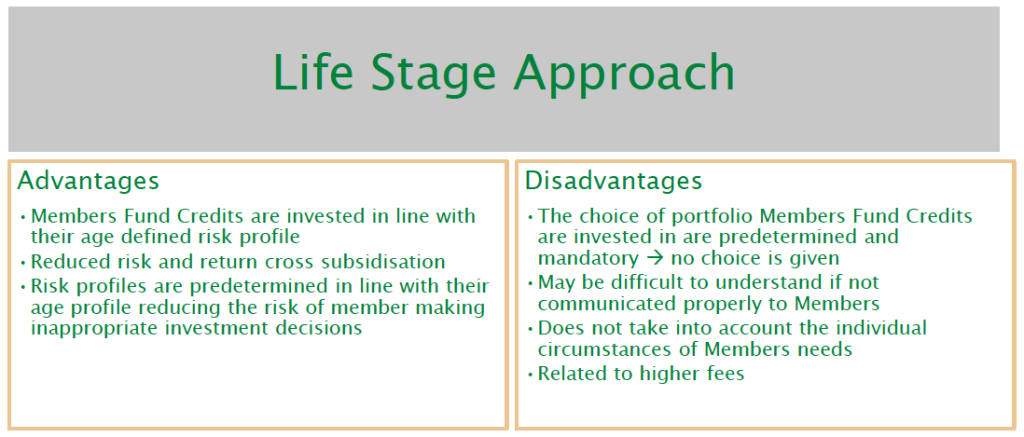

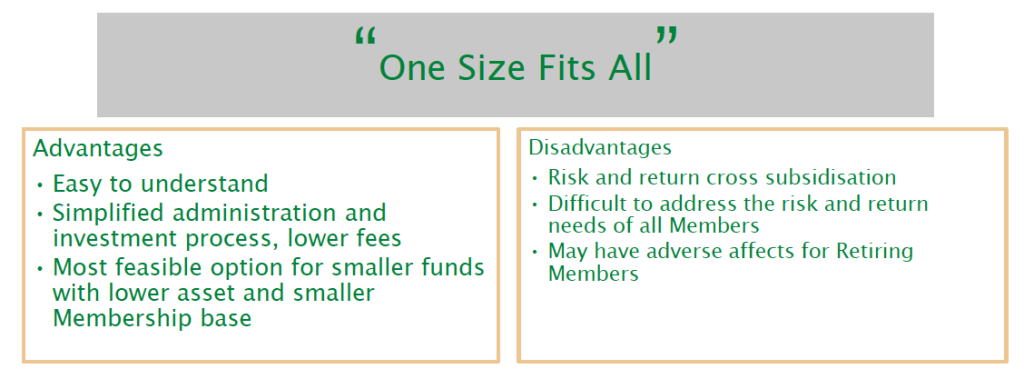

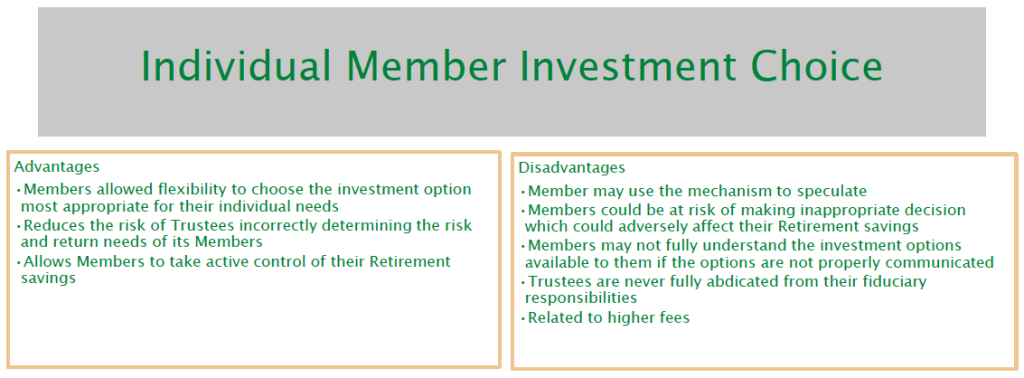

There are a number of approaches to investing ahead of retirement. Deresh compared life stage investing, the one-size-fits-all approach and individual member investment choice.

Life stage investing sees fund managers taking an aggressive, high-risk approach for young investors, a moderate approach for mid-life investors and a more conservative approach for pre-retirement investors.

The one-size-fits-all approach, on the other hand, consolidates the returns from a range of investment approaches (from conservative to aggressive) and spreads them equally among investors at all life stages.

And as the name implies, the individual member choice approach gives the investor the option to select from a range of investment types, regardless of their life stage.

See the advantages and disadvantages of each approach below:

The income replacement ratio

This is your post-retirement income expressed as a proportion of your pre-retirement income. So, if you were earning R10 000 per month before retirement and your retirement income is R7 500 per month, then your income replacement ratio is 75%.

“Your income replacement ratio quantifies your ability to maintain a similar lifestyle post retirement to what you enjoyed while you were working,” explains Deresh. “Usually if you can hit an IRR of 70% you’re doing well.

“Remember, a number of your fixed costs should fall away after retirement, like transport costs for example. Also, your home should ideally be paid off and your kids should be fully independent.

“In a large number of cases your cost of living will be lower as you scale down your lifestyle, perhaps by purchasing a smaller house or moving to a small town or village.”

Thanks to our poor savings culture, the current IRR is in the region of 30%, which means most South Africans will not have enough money to maintain their standard of living after retirement.

One of the ways to improve your retirement funding is by preserving your benefits when you change jobs.

“Currently only 10 to 15% of members preserve their benefits when moving from one employer to another,” says Deresh. “If all benefits were preserved, with no leakages in the system, the industry has the potential to achieve an 80% IRR!”

Here are some of the reasons why we fall short:

- Generally, there is a poor culture of saving among South Africans

- Members choose to withdraw rather than to preserve retirement benefits when changing employment

- General short-term working periods due to the difficulty of securing long-term, permanent positions, implies that some individuals are forced to delve into their retirement savings during periods of unemployment

- A shorter-term employment period to retirement does not allow for the significant accumulation of benefits, hence lower IRRs are expected at older ages

Members may choose to re-invest their retirement savings or purchase a real asset that positively contributes to their post retirement lifestyle.

What happens to your investment when you retire?

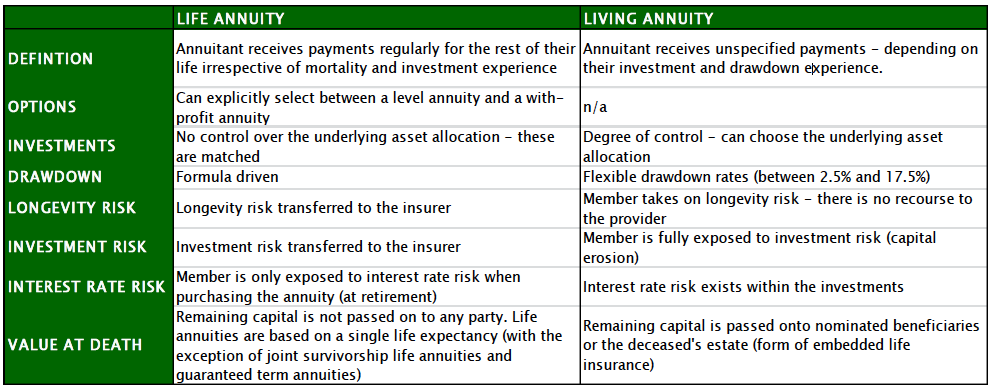

Retirement fun members are given the option of choosing a life annuity or a living annuity. A life annuity means you get paid a regular amount of money each month for the rest of your life. If you choose a living annuity, your money gets re-invested and you receive payments depending on the performance of your investment and the level of drawdown you opt for.

Here’s a summary of the differences between the two strategies:

If you would like to speak to someone about your individual retirement savings requirements, visit the RISE website.

Szpiegowskie Telefonu

Jak odzyskać usunięte SMS – Y z telefonu komórkowego? Nie ma kosza na SMS – Y, więc jak przywrócić SMS – Y po ich usunięciu?