Insure against pain and scandal on the stock market

What if you acquired Steinhoff shares just before the company crashed on the JSE? Or if you bought into EOH before the management debacle that sent the stock price plummeting? Well, if you’d been covered by Investsure (available through our friends at EasyEquities), your losses would have been hugely mitigated.

“2018 was a very volatile year for the JSE, with the market ending over 11% in the red overall,” explains Investsure co-founder Mbulelo Mpofana.

“The significant decline surprised many as it followed a strong showing in 2017 where the FTSE/JSE All Share Index gained nearly 17.5%. The value destruction was widespread, with 30% of the exchange shedding over 20% within the year.”

Mbulelo says ordinary investors can be forgiven for feeling dismayed as, “… a significant amount of the losses were caused by accusations of wrongdoing on the part of management, effectively blindsiding shareholders.”

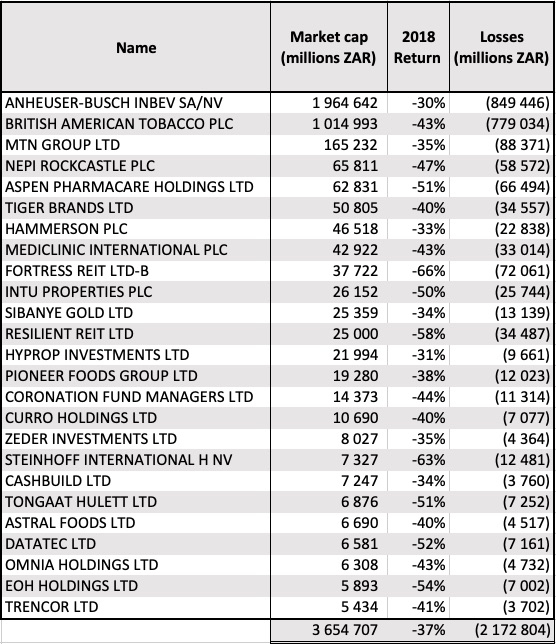

The Investsure team had a look at the companies with a market capitalisation of over R5 billion as at the end of the year – roughly equivalent to the Top 150 listed stocks – and identified the worst-performing 25 stocks. Multinational giants British American Tabaco (BAT) and AB INBEV (ANH) made the list of worst performing shares, shedding 43.4% and 30.2% in value respectively. The Investsure analysis focused on the remaining 23 stocks, which lost a total of R544 billion. BAT and ANH were excluded due to their significantly larger size.

Table 1: Worst performing 23 JSE listed stock with market cap over R5bn

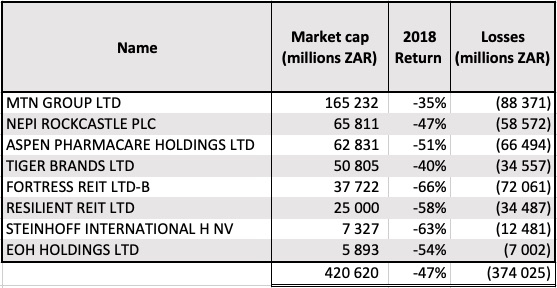

Of these worst performing shares, eight (35%) were significantly impacted by accusations of management fraud. (Sibanye also faced accusations of management wrongdoing but without significant consequence to the share price; their sharp decline was caused by other factors.) These eight companies combined lost over R374 billion, representing a massive 69% of the total value lost by the 23 companies listed above.

Table 2: Worst performing shares accused of management fraud

It is also worth noting that Steinhoff and EOH were hit with scandals towards the end of 2017 which resulted in losses of around R283 billion (93%) and R 18 billion (59%) respectively in that year. Both companies extended their huge losses in 2018 as new information and accusations of wrongdoing surfaced.

“InvestSure’s Investment Indemnity product provides shareholders with a simple tool to manage their exposure to management fraud risk,” explains Mbulelo. “The world-first insurance offering is backed by quality paper in the form of Hannover Re’s subsidiary, Compass Insure.

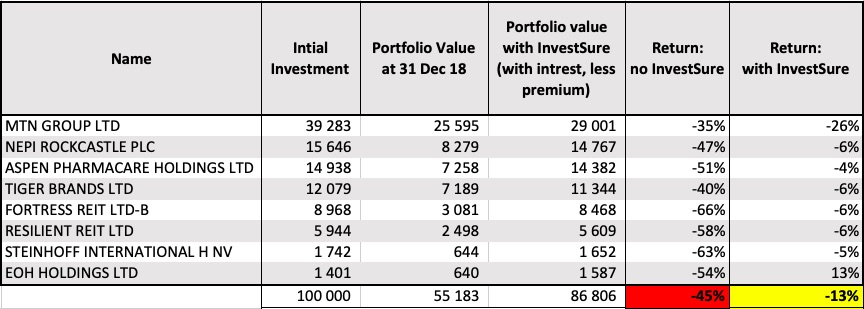

Mbulelo and his team modelled what the impact would have been on a client portfolio worth R100 000 that was exposed to all eight shares, weighted by market cap.

“We assumed the client bought InvestSure’s insurance product at the beginning of the year, sold their shares on day one of the claims periods and earned interest on the cash for the remainder of the year at a rate of 6% p.a.”

The results after accounting for the cost of insurance are depicted in Table 3 below.

Table 3: Portfolio performance with and without insurance

“The results clearly demonstrate the value of the insurance offering to limit exposure to fraud risk,” Mbulelo points out. “After accounting for the cost of insurance, the portfolio with insurance would have lost 13% compared to a 45% loss for the portfolio with no insurance.

“Even on a very diverse portfolio weighted by market cap across the Top 150, the portfolio with insurance in place would outperform with a return of -10% compared to -12% on the same portfolio without insurance.”

The sheer number and magnitude of recent scandals on the bourse has led to the JSE considering changes to tighten listing rules following public criticism. If implemented, new measures – such as requiring the public disclosure of information on short sales – could help protect investors… but are no means a catch-all!

“2018 and 2017 illustrated how difficult (if not impossible) it is to spot management fraud,” says Mbulelo. “A well-known asset manager once said to me, ‘Fraud comes like a thief in the night.’ If the fraudster is any good, you won’t see it coming.”

It’s important for investors to assess whether management fraud risk is a risk they are willing to accept, he adds. “This is a growing risk category driven by activist investors, activist short sellers, greater access to information, high frequency trading, shareholder activism and investigative journalism.

“Investment insurance is a simple, low-cost and effective risk transfer mechanism for management fraud risk, backed by world-class insurance capital.”

Investors can currently cover the shares in their portfolios on the Easy Equities trading platform – www.easyequities.co.za. Investment insurance will soon be available to Sharenet clients as well.