How would we invest R10 million today?

A recent article in Financial Mail put the question to 17 asset managers… Where would you invest R10 million in today’s upside-down Covid world? We thought it was a great question (and a great article). So we decided to ask our favourite asset manager, Emperor Asset Management, the same question.

Emperor is one of CN&CO’s founding clients and, as part of Purple Group, is a sister company to EasyEquities.

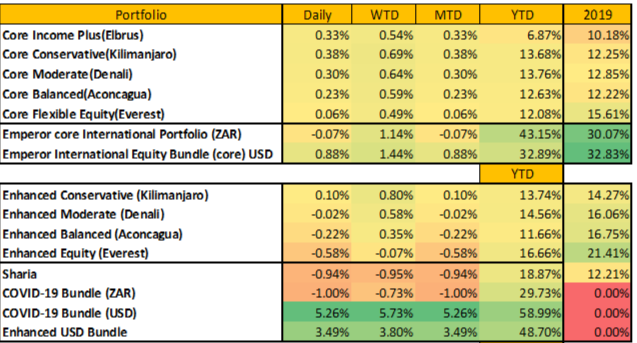

The performance of Emperor’s funds has been phenomenal, by the way. Check out the returns in the table below (focus on the year-to-date column). Pretty impressive stuff!

Anyway, back to the question: Where would you invest R10 million in today’s upside-down Covid world? Here’s Emperor’s response:

If we had R10 million to invest right now we would invest R4.5 million into offshore equities and R5.5 million into domestic equities.

Offshore

The offshore component we would invest along the lines of the IP Global Momentum Equity Fund, which Emperor Asset Management manages. This fund has returned 82.44% so far in 2020. It is the top performing fund in its category over one, two and three years, with a three-year annual average return of 40.3% according to ASISA, with the next best fund having an average return of 29.4% p.a. and the category average return of 14.88% p.a.

Using our algorithmic approach, this fund is built around a specific portfolio. We would suggest an investor build a portfolio around those companies engaged in e-commerce, financial technology, cloud computing and security, automation and AI, and brands that embrace millennial culture. We are invested in other themes as well, but this is the core of the portfolio.

Examples include Roku, which has achieved pole position in the connected TV market in the United States, allowing it to continue to grow its ad monetisation (50% year-over-year growth in the second quarter of 2020) and being the gateway platform for all over the top content producers such as Disney+. Brands such as Lululemon, RH and Nike are growing their direct-to-consumer distribution as well as their in-store offerings and are thus building relationships with their consumers. Etsy is using machine learning to continue to personalise recommendations for online consumers, while Fastly is powering the infrastructure of the Cloud and OKTA is keeping your access secure.

One of the key elements in all financial portfolios is diversity, which becomes even more important when you are investing this amount of money. Investing offshore requires the expertise to ensure you have the required diversification between companies, currencies and economies.

When investing offshore you may choose to go directly offshore, which would mean you need to convert your rands in dollars. You would receive much fewer dollars for your rands, but the historical weakening of the rand means that you would make more in currency movements over the longer term in dollars. You can also choose to leave your money in rands but invest in a feeder fund, where you get exposure to offshore assets, but the investment remains in South Africa.

From an estate planning perspective, this is a vital component of your investment consideration when investing R10 million. You can choose to invest your funds in an overseas wrapper, which means when you do pass away, the funds do not need to return to South Africa. They can remain overseas and in the name of the second life assured.

Each taxpayer has a R1 million discretionary offshore investment allowance and a further R10 million per annum with approval from SARS.

Local

We would invest in local equities in a similar way as we construct the portfolio for IP Unit Trust, also managed by Emperor Asset Management. This is a relatively recent fund with only about 18 months of track record. However it is the top performing fund over one year according to ASISA with a 29.35% return compared to the ASISA category average return of 3.84%.

Once again, companies are selected on an algorithmic basis by investing in momentum, stability, quality and value characteristics.

As of now, this portfolio is quite specific with exposure to Prosus, mining (platinum and gold), pharmaceuticals, brands and offshore earners. Gold and platinum come into the portfolio due to their leverage to the underlying materials and expected strength in commodity prices due to quantitative easing. We like Tencent, hence our Prosus exposure, and we have exposure to South African quality brands and well run companies. This portfolio needs to be more regularly adjusted than the international portfolio due to its much more cyclical nature. We like Richemont and Quilter due to their offshore exposure.

With your local investment you will need to consider when and how much of an income you may need to draw down from your investment. This will also impact your investment strategy and exposure to equities. If you require an income in the short term, you may need to balance your portfolio further and have some bond funds and even money market instruments in your portfolio.

At this point in time, consider your risk profile or investment personality. You should not invest in an instrument that will give you sleepless nights.

Your age is also an important component to this example; what lifestyle expenses are you going to be going through in the next few years? If you are 25 years old, a new house, new car and lifestyle upgrade could be on the cards. You do not want to invest the cost of these items in an equity portfolio. Put some cash aside for these expenses.

Locally, you may want to consider some investment vehicles that do come with tax benefits. The use of a trust may be an option in certain situations, but not for everyone. Consider all options before deciding.

About Emperor Asset Management

Emperor is an algorithmic asset manager that uses technology such as machine learning to make investment decisions. The algorithms look for patterns in various places in the market and invests according to that analysis. For example, it will look at the relationship between SA equities and US/UK/China/etc. equities, between those equities and bonds/gold/platinum/etc. and within all individual equities how momentum/growth companies are performing relative to value/quality/ dividend/etc. companies. This determines its asset allocation decisions.

Why does Emperor put so much weight on algorithms? Investor behaviour is irrational and prone to many behavioural biases. This can best be summed up by Daniel Kahneman, the Nobel prize winner in economics and one of the “founders” of behavioural economics:

“It’s very difficult to imagine from the psychological analysis of what expertise is that you can develop true expertise in, say, predicting the stock market. You cannot because the world isn’t sufficiently regular for people to learn rules. This is psychologically a puzzle. How could one learn when there’s nothing to learn?

“You should learn that the world is more uncertain than you think.

“When there’s the possibility of using an algorithm, people should use it. We have the idea that it is very complicated to design an algorithm. An algorithm is a rule. You can just construct rules.”

The Emperor algorithm looks for what are known as building blocks, that is the team analyses all the company’s fundamentals and invests in a combination of companies that exhibit momentum, value, stability and quality.

For more information on Emperor Asset Management visit https://emperor.easyequities.co.za/.

Source: Emperor Asset Management as at September 2020. Past performance is not indicative of future performance. The contents of this article must not be construed as financial advice. It is the opinion of the asset manager and does not take into account the appropriateness of the particular investment objectives, financial situation or particular needs of a client.

Emperor Asset Management (Pty) Ltd is an Authorised Financial Services Provider (FSP Number 44978).

Leave a Reply