Cartesian Talks 5: Let’s talk about shorts

Cartesian Capital MD Anthea Gardner has hosted yet another phenomenal instalment of the Cartesian Talks webinar. For this episode she was joined by hedge fund wizard Stephán Engelbrecht. The topic was “The difference between shorts and short-shorts”.

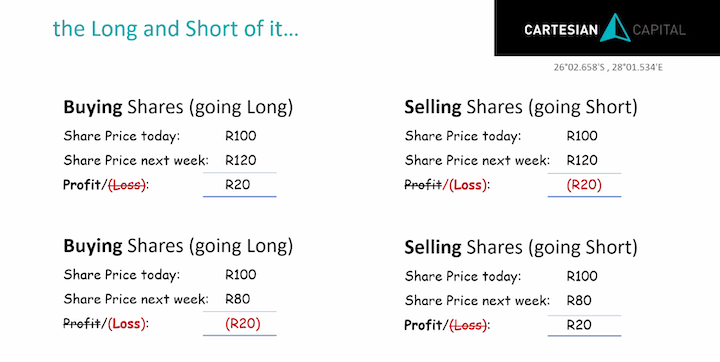

We all know what short-shorts are, but the concept of shorts, as it pertains to the investment industry, is a bit trickier to understand. Basically it means you score if the price of a share drops. So you’re essentially “betting against the share price going up”.

Both Anthea and Stephán suggested that investors stay away from shorting stocks.

“We would not recommend shorting,” said Stephán. “Firstly, your maximum profit is 100%. Secondly, it’s unlikely that you’ll catch the short. Steinhoff and African Bank are rare occurrences. The odds are always in your favour to go long.”

Short trades, he added, have a place in a hedge fund portfolio, but for retail investors the overwhelming recommendation was for retail investors to go long.

Also, as a retail investor it’s not advisable to use shorting as part of your portfolio because then you’re moving into trading territory.

We also looked at lots of graphs (what would a Cartesian Talks session be without Anthea’s graphs?) and learnt about a typical day for an asset manager and hedge fund manager. Basically, getting into this field is not as glamorous as the movies make it out to be. But it’s still exciting, say Anthea and Stephán.

Anthea was very complimentary about the event management skills of the CN&CO Events team, singling out (birthday boy) Llewellyn du Plessis for the professional way the webinars are run, and also thanking him for organising CPD accreditation for those who register and attend. Anthea also thanked CN&CO’s Carel Nolte for his superb hosting skills at each event.

If you missed it, you can watch the webinar below. (Contact llewellyn@cnandco.com before you watch if you would like to earn CPD hours for watching.)

The next Cartesian Talks, on 6 August 2020, will deal with offshore investing. Keep an eye on @cnandco and @CartesianCap for booking details.

Leave a Reply