100 Women in Finance chat all things investment

Men were in the minority at the recent 100 Women in Finance education session, held at the Higher Ground function venue in Sandton, where the theme was “Start your investment journey today”. Speakers came from a cross section of the savings and investment industry.

The event was hosted by Nicola Comninos of Purple Group, holding company of EasyEquities, EasyCrypto and EasyProperties, who also sponsored the evening.

Snowy Masakale of Benguela Global Fund Managers was first on the mic. She provided some practical tools for starting a share portfolio and shared her personal journey of investing in equities.

“Although I have been in financial services for a long time, it was a very hard decision when it came to choosing my first stock,” she said. “The most important thing to remember when investing in a company is that you have to understand what they do.”

Snowy also revealed some interesting stats about gender when it comes to investing. A study published in the Journal of Financial Counseling and Planning in 1997, she said, found that women were more likely to hold risky assets if they expecting an inheritance, or if employed and holding higher net worth, while men invested in risky assets if they were risk seekers, divorced, older and college educated.

“The concept of investing is quite broad and complex for many reasons but it’s important that we make it real. We have to talk about our perceptions,” she said, before proceeding to share and debunk some commonly held misconceptions about investing. These were:

1. High risk stocks guarantee high returns.

2. Stock prices that fall will always come up again.

3. You always need the assistance of a stockbroker to invest.

4. The stock market is just for wealthy people.

5. Investing is about speculating.

6. You’re too young or too old to invest.

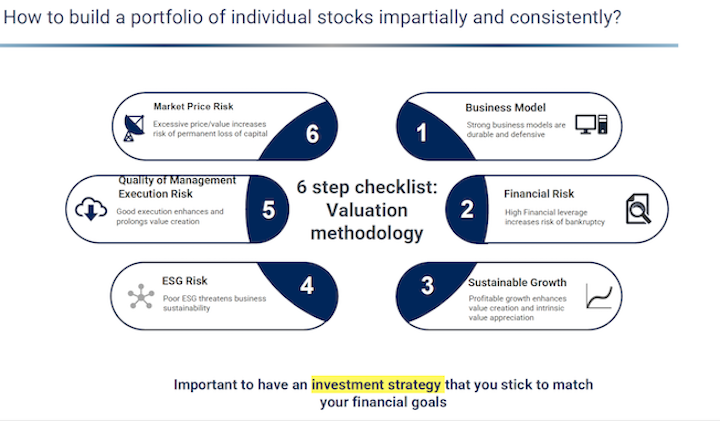

Snowy outlined her checklist on how to build a portfolio of individual stocks, which appears in the slide below:

She concluded her presentation by talking about the concept of diversification, pulling together the key principles of correlation (between your stocks), understanding economic cycles, the sectors and industries in which your stocks are held, geography and resistance to competition and other external factors such as political and environmental considerations.

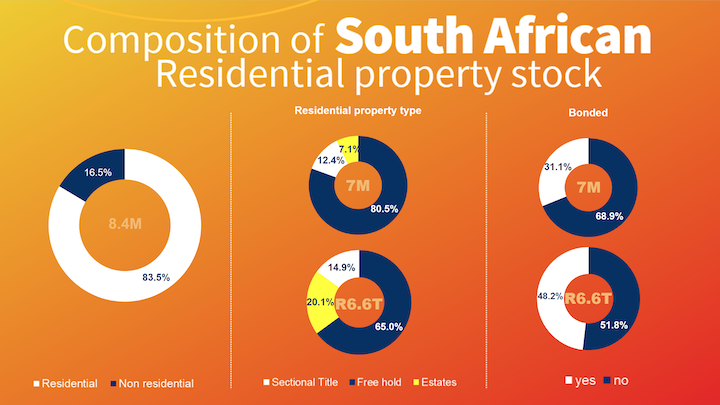

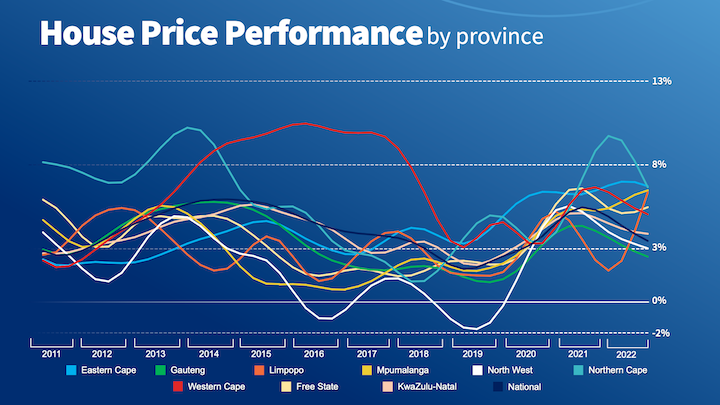

Lightstone‘s Hayley Ivins Downes gave a fascinating insight into the property market in South Africa, highlighting price and movement trends in the domestic market.

She started with the old adage, “Location, location, location!” Hayley’s stats were extremely revealing, with a few surprises here and there. Estates, for example, make up seven percent of the property market, yet account for 20 percent of its total value.

“This gives you an indication of where the value is actually sitting,” she said.

Another interesting stat is what is bonded.

“Thirty-one percent of seven million homes are bonded, representing a value of 48 percent,” she said. “So we have quite a big bond market – but, in reverse, the rest is cash! That in itself also speaks to something.”

Bryanston, she said, is a very interesting suburb at the moment, with a lot of transactions taking place there.

“It’s very much a buyer’s market,” she said. “But something to remember about property – it is a long term investment. And if you’re wanting to get into property as an investment, buy off plan. Transfer costs will hurt you. Remember, you need to get those costs back in the value of your property and that in itself will take years.”

(Nicola, of course, immediately shot back with an alternative, which is to invest in EasyProperties, where transfer costs are not as much of an issue. She also mentioned REITs as an alternative option to investing in property.)

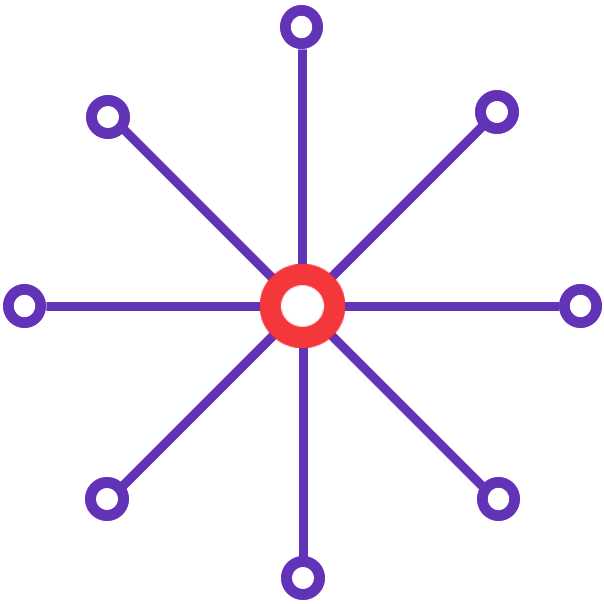

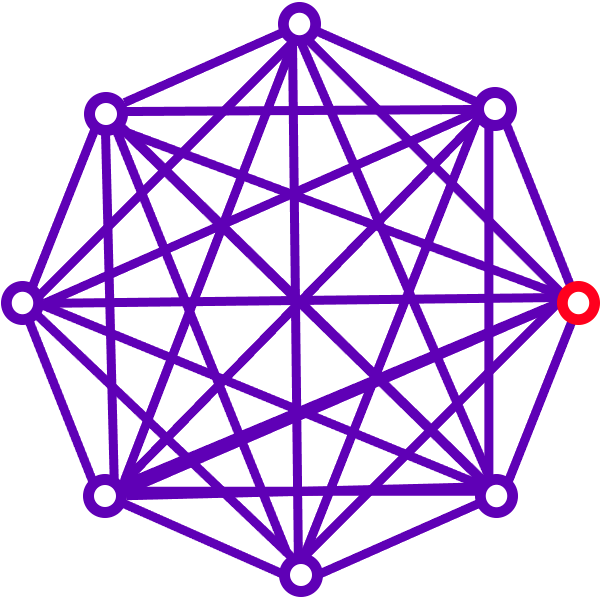

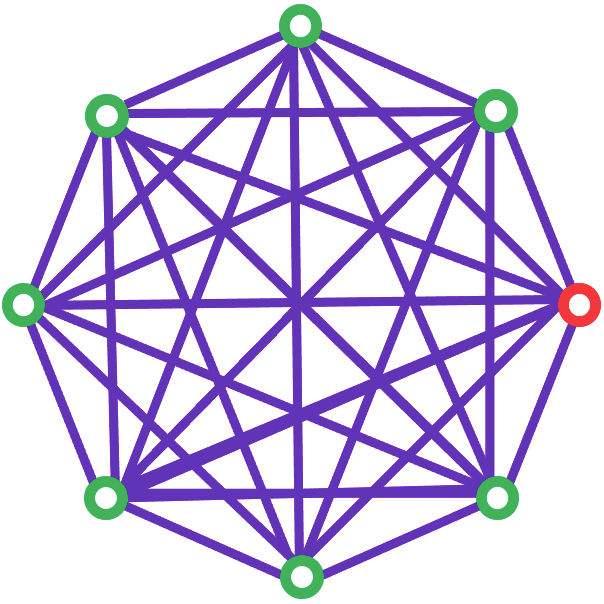

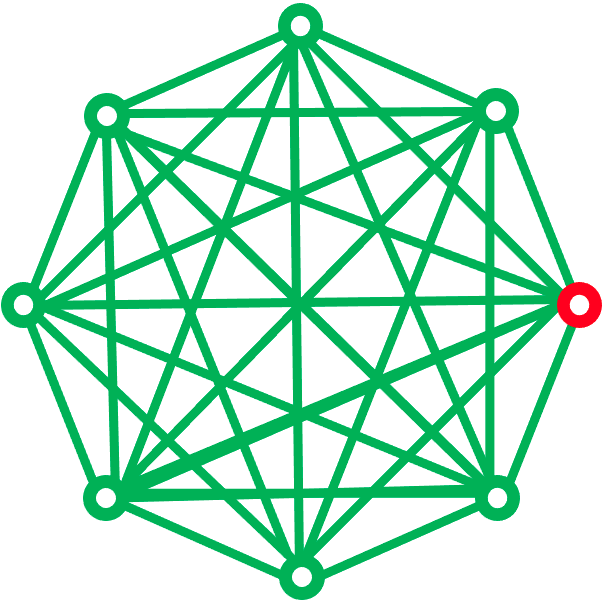

The next speaker was EasyCrypto’s Don Kruger. Don beautifully explained the principle of decentralisation, which he says is a fundamental concept of the Blockchain and cryptocurrency.

“If all your transactions and events go through one node and that node goes down, the entire system crashes,” he explained (as set out in the diagram above). “However, if all your nodes are connected and one goes down, the system can still stay up.”

In this context, the centralised system would be the traditional or legacy banking system.

“When the central node fails, the entire integrity of the system is compromised,” he said.

The Blockchain represents a decentralised system that’s less likely to crash.

“Blockchain fundamentally solves the middle man problem of money and the issue of centralisation risk, specifically in financial systems. If we have a node that fails in a decentralised distribution protocol and that node, whether it be hacked or compromised in any way, the rest of the system – the rest of the nodes in that Blockchain, keep the system intact. And that is why this is such a powerful technology.”

But what is the intrinsic value of the Blockchain?

“It’s in the argument I just laid out – it’s decentralised and therefore stable,” said Don. “But, it relies very strongly on distribution, participation and belief in that system in order to function – the same principles that uphold the cotton- and nylon-backed money that we use today.”

Don said the ideal investment portfolio should hold 2.5 to 3 percent crypto assets.

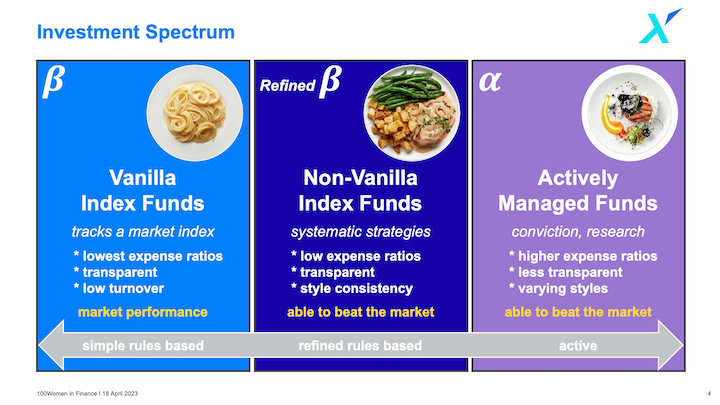

Next in the proverbial hot seat was Fikile Mbhokota of Satrix.

“Stock picking is more difficult than it may seem,” she said. “It is nearly impossible for an average investor to consistently pick the right stocks and beat the market all the time. You are better off owning the whole market in a low-cost investment. [Buying into an index fund] removes the significant risk of an individual stock that’s completely underperforming the market.”

Fikile took the audience through the investment spectrum, unpacking the various types of index (passively managed) funds and actively managed funds, and the pros and cons of each.

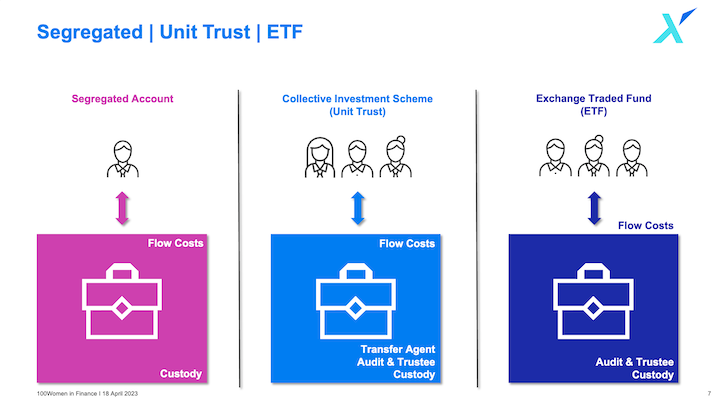

She also explained the different types of asset classes that an investor can choose, as well as the differences between segregated accounts, unit trusts and ETFs when it comes to managed funds.

The speakers then participated in a panel discussion, where they answered investment questions from the audience, before the event ended.

Event host 100 Women in Finance is “committed to building a more diverse and gender equitable finance industry by promoting diversity of thought, raising visibility, and empowering women to find their personal path to success.”

If you are interested in becoming part of the local chapter of 100 Women in Finance, send an email to southafrica@100women.org.

Leave a Reply